| | Marillyn A. Hewson

2021 Performance and Compensation

A Message from Our Compensation & Benefits Committee Chair

| | Mark A. Weinberger | | | | | | | | | | | | | Regulatory Compliance & Sustainability Committee Chair | | Joaquin Duato Finance Committee Chair | | | | | | | | | | | |

For 2024, the Board decided to continue with a leadership structure composed of a combined Chairman and CEO partnered with a strong Lead Director. In reaching this decision, the independent Directors leveraged their combined experience across corporate leadership, academia and healthcare. Having one leader with deep industry experience and Company knowledge in a combined Chairman and CEO role provides clear accountability and decisive and effective leadership. Working alongside a strong Lead Director, this structure also allows the independent Directors to appropriately challenge management and demonstrate the independence and free thinking necessary for effective oversight. The Board believes there is no single leadership structure that is optimal in all circumstances. Instead, the Board considers the most appropriate leadership structure to provide responsible oversight and create long-term sustainable value for our shareholders in the context of the specific circumstances and challenges facing the Company. The Board also considers feedback from investors and other stakeholders in determining the leadership structure. More information on our leadership structure can be found in our Principles of Corporate Governance at www.investor.jnj.com/corporate-governance. The Nominating & Corporate Governance Committee reviews the Board's leadership structure on an annual basis and at other appropriate times, including whether the roles of Chairman and CEO should be held by one individual or should be separated. The Committee makes a recommendation to the Board for consideration based on the following items: •The effectiveness of the policies, practices and people in place at our Company to help ensure strong, independent Board oversight. •Our Company’s performance and the effect a specific leadership structure could have on its performance. •The Board’s performance and the effect a specific leadership structure could have on its performance, including the Board's efficacy at overseeing specific Enterprise risks. •The Chairman’s performance in that role (separate and apart from performance as CEO, if applicable). •The views of our Company’s shareholders as expressed both during our shareholder engagement and through voting results at shareholder meetings. •Applicable legislative and regulatory developments. •The practices at other similarly situated companies and trends in governance.

Strong Lead Director The Lead Director provides strong independent leadership of the Board and maintains frequent contact with the Chairman and CEO. Please also see A Message from our outgoing Lead Director on page 5 of this Proxy Statement, which illustrates how the Lead Director and the Board are providing rigorous, independent oversight of our Company. The independent Directors firmly believe that the Company’s current Board structure, with a robust Lead Director and its main committees each composed entirely of independent Directors, provides appropriately strong independent leadership and oversight as well as efficient and clear leadership, communication and administration. The Board will continue to monitor Board leadership, considering what it observes in the marketplace, the evolution of viewpoints in the corporate governance community and, most importantly, what the Board believes is in the best interests of our Company and its shareholders. Duties and responsibilities of the Lead Director | | | |  | | | | | | | Board agendas, information and schedules | •Approves information sent to the Board and determines timeliness of information flow from management. •Provides feedback on quality and quantity of information flow from management. •Participates in setting, and ultimately approves, the agenda for each Board meeting. •Approves meeting schedules to ensure sufficient time for discussion of all agenda items. •Partners with the Chairman and CEO to determine who attends Board meetings, including management and outside advisors. | | Committee agendas and schedules | •Reviews in advance the schedule of committee meetings. •Monitors flow of information from committee chairs to the Board. | | Board executive sessions | •Has the authority to call meetings and executive sessions of the independent Directors. •Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent Directors. | | Communicating with management | •After each executive session of the independent Directors, communicates with the Chairman and CEO to provide feedback and also to act upon the decisions and recommendations of the independent Directors. •Acts as liaison between the independent Directors and the Chairman and CEO and management on a regular basis and when special circumstances arise. | | Communicating with stakeholders | •Meets with major shareholders or other external parties. •Is regularly apprised of inquiries from shareholders and involved in responding to these inquiries. •Under the Board’s guidelines for handling shareholder and employee communications to the Board, is advised promptly of any communications directed to the Board or any member of the Board that allege misconduct on the part of Company management, or raise legal, ethical or compliance concerns about Company policies or practices. | | Chair and CEO performance evaluations | •Leads the annual performance evaluation of the Chairman and CEO, considering separately performance as Chairman and performance as CEO. | | Board performance evaluation | •Leads the annual performance evaluation of the Board. | | New Board member recruiting | •Interviews Board candidates, as appropriate. | | CEO succession | •Leads the CEO succession planning process. | | Crisis management | •Participates in crisis management oversight, as appropriate. | | Limits on leadership positions of other Boards | •May only serve as chair, lead or presiding director, or similar role, or as CEO of another public company if approved by the Board upon recommendation from the Nominating & Corporate Governance Committee. |

Lead Director transition The Board places an emphasis on its succession planning responsibilities. Ms. Mulcahy has served with distinction as Lead Director since 2012. Consistent with the Board’s approach to effective succession planning and following extensive discussion, review and recommendation from the Nominating & Corporate Governance Committee, the independent Directors of the Board have appointed Ms. Hewson to succeed Ms. Mulcahy as Lead Director effective following the 2024 Annual Meeting. This planned timing provides an adequate period of transition as Ms. Mulcahy continues her Board service. Qualifications of Ms. Hewson The independent Directors believe that Ms. Hewson is well-positioned to serve as Lead Director. With her previous role as Chair and Chief Executive Officer of a large multinational corporation, as well as her former and current roles on public company boards that operate in a variety of industries and businesses, Ms. Hewson brings to the Lead Director role a career of leading global, complex, regulated organizations and a continued commitment to business innovation and talent development. This expertise, combined with her experience in the board room and knowledge of both Johnson & Johnson and its strategic objectives, place Ms. Hewson in a unique position to assume the responsibilities of Lead Director. Board committees The Board has five main standing committees: Audit, Compensation & Benefits, Nominating & Corporate Governance, Regulatory Compliance & Sustainability, and Science & Technology, each composed entirely of non-employee Directors determined to be independent under the listing standards of the NYSE and our Standards of Independence. Under their written charters adopted by the Board (available on the Company's website at www.investor.jnj.com/governance/corporate-governance-overview), each of these committees: •Is authorized and assured of appropriate funding to retain and consult with external advisors, consultants and counsel. •Conducts an annual evaluation of its performance fulfilling its duties. •On an annual basis, reviews and reassesses the adequacy of its charters. •Reports regularly to the Board on its meetings and reviews with the Board significant issues and concerns that arise at committee meetings. In addition, the Board has a standing Finance Committee, composed of the Chairman and CEO and the Lead Director, which exercises the authority of the Board between Board meetings in accordance with our Company's By-Laws. At the end of 2021, the Board formed a special committee (Consumer Health Special Committee) to oversee the separation of the Company’s Consumer Health business from its pharmaceutical and medical technology businesses (the Separation Transaction). The Consumer Health Special Committee operated under a written charter adopted by the Board. The Consumer Health Special Committee met six times during 2023 and was disbanded after the completion of the Separation Transaction.

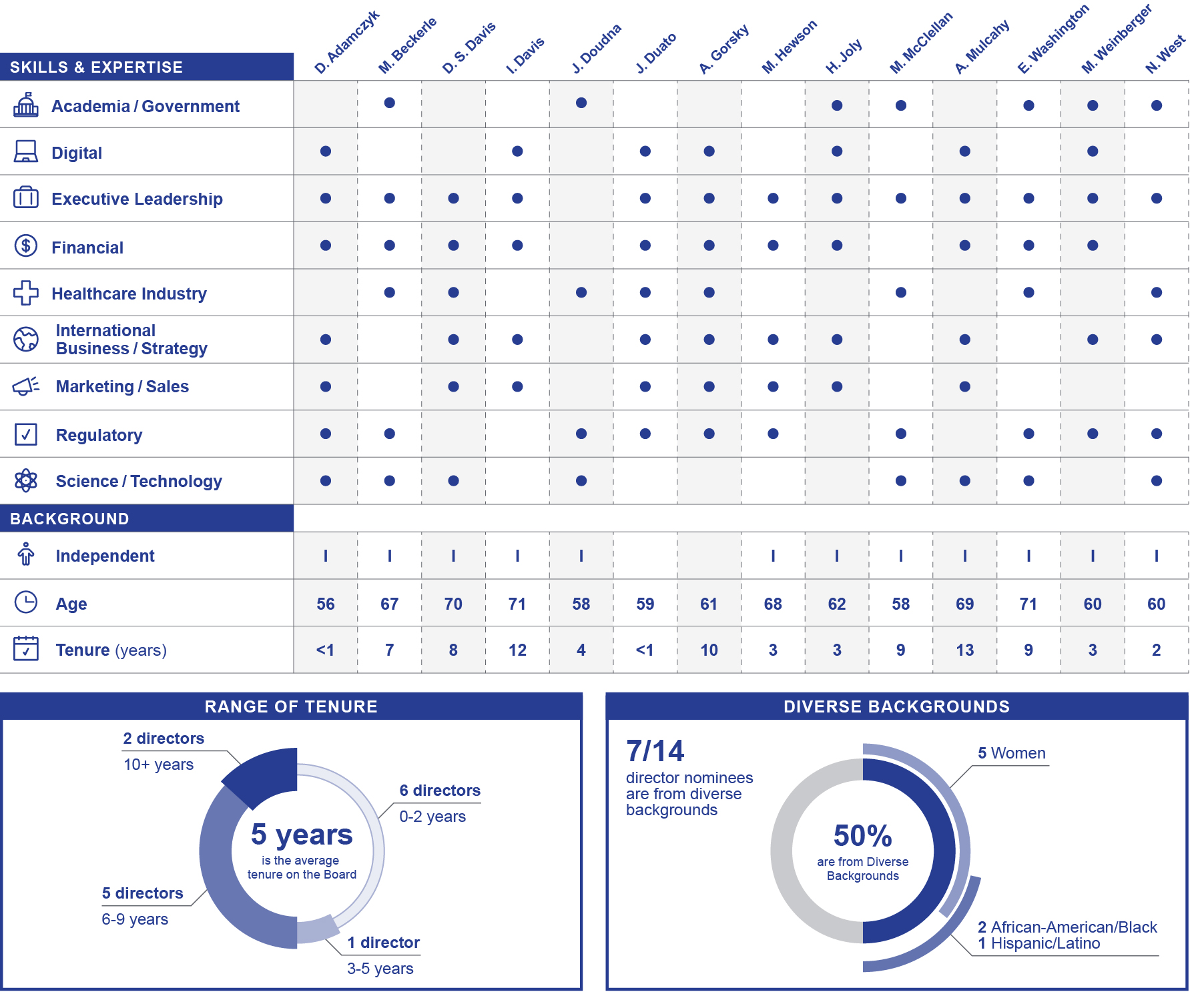

Board committee membership The following table shows the members and Chair of each of the Board committees and the number of meetings each committee held in 2023. Directors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name | Ind. | Age | Director Since | Primary Occupation | Board committees | | AUD | CB | NCG | RCS | ST | FIN | | D. Adamczyk | I | 58 | 2022 | Executive Chairman; Former Chairman and Chief Executive Officer, Honeywell International Inc. | | | | | | | | M. C. Beckerle | I | 69 | 2015 | Chief Executive Officer, Huntsman Cancer Institute; Distinguished Professor of Biology, College of Science, University of Utah | | | | | C | | D. S. Davis(1) | I | 72 | 2014 | Former Chairman and Chief Executive Officer, United Parcel Service, Inc. | C | | | | | | | J. A. Doudna | I | 60 | 2018 | Professor of Chemistry; Professor of Biochemistry & Molecular Biology; Li Ka Shing Chancellor's Professor in Biomedical and Health, University of California, Berkeley | | | | | | | | J. Duato | CH | 61 | 2022 | Chairman of the Board and Chief Executive Officer, Johnson & Johnson | | | | | | C | | M. A. Hewson | I* | 70 | 2019 | Former Executive Chairman, Chairman, President and Chief Executive Officer, Lockheed Martin Corporation | | C | | | | * | | P. A. Johnson | I | 64 | 2023 | President, Wellesley College | | | | | | | | H. Joly | I | 64 | 2019 | Former Chairman and Chief Executive Officer, Best Buy Co., Inc. | * |  * * | | | | | | M. B. McClellan | I | 60 | 2013 | Director, Duke-Robert J. Margolis, MD, Center for Health Policy | | | | | | | | A. M. Mulcahy | LD* | 71 | 2009 | Former Chairman and Chief Executive Officer, Xerox Corporation | | | C | | |  * * | | M. A. Weinberger | I | 62 | 2019 | Former Chairman and Chief Executive Officer, Ernst & Young | | | | C | | | | N. Y. West | I | 62 | 2020 | Former Lieutenant General, U.S. Army | | | | | | | | E. A. Woods | I | 59 | 2023 | Chief Executive Officer, Advocate Health | | * | | | | | Number of meetings in 2023(2) | 15(3) | 7 | 4 | 5 | 4 | 0 |

(1)Designated as an Audit Committee financial expert (2)Inclusive of joint and special meetings among committees (3)Does not include virtual meetings held prior to each release of quarterly earnings (four in total) * At our April 2024 Board meeting, the following 1) appointments will be effective: Ms. Hewson, LD; Ms. Hewson, FIN; Mr. Joly, AUD; Mr. Woods, CB; and 2) removals will be effective: Mr. Joly, CB; Ms. Mulcahy, FIN. | | | | | | | | | | | | | CH | Chairman of the Board | CB | Compensation & Benefits Committee | | C | Committee Chair | NCG | Nominating & Corporate Governance Committee | | I | Independent Director | RCS | Regulatory Compliance & Sustainability Committee | | LD | Lead Director | ST | Science & Technology Committee | | AUD | Audit Committee | FIN | Finance Committee |

Board committee responsibilities Copies of the charters of all committees of the Board, except the Finance Committee, are available at www.investor.jnj.com/governance/corporate-governance-overview. | | | | | | | | | | | | | | | | Audit Committee | Roles and responsibilities •Oversees our financial management, accounting and reporting processes and practices. •Appoints, retains, compensates and evaluates our independent auditor. •Oversees our global audit and assurance organization, reviews its annual plan and reviews results of its audits. •Oversees the quality and adequacy of our Company’s internal accounting controls and procedures. •Reviews and monitors our financial reporting compliance and practices and our disclosure controls and procedures. •Discusses with management the processes used to assess and manage our exposure to financial risk and monitors risks related to tax and treasury. In performing these functions, the Audit Committee meets periodically with the independent auditor, management and internal auditors (including in private sessions with each) to review their work and confirm that they are properly discharging their respective responsibilities. For more information on Audit Committee activities in 2023, see the Audit Committee Report on page 122. The Board has designated Mr. D. S. Davis, the Chair of the Audit Committee and an independent Director, as an audit committee financial expert under the rules and regulations of the U.S. Securities and Exchange Commission (SEC) after determining that he meets the requirements for such designation. The determination was based on his being a Certified Public Accountant and his experience as Chief Financial Officer at United Parcel Service, Inc. Any employee or other person who wishes to contact the Audit Committee to report good faith complaints regarding fiscal improprieties, internal accounting controls, accounting or auditing matters can do so by writing to the Audit Committee c/o Johnson & Johnson, Office of the Corporate Secretary, One Johnson & Johnson Plaza, New Brunswick, NJ 08933, or by using the online submission form at the bottom of www.investor.jnj.com/governance/corporate-governance-overview. Such reports may be made anonymously. * Includes four virtual meetings held prior to each release of quarterly earnings as well as joint meetings with each of the Consumer Health Special Committee, Regulatory Compliance & Sustainability Committee, and Compensation & Benefits Committee. | | | | 15* Meetings in 2023 | | | | Members •D. S. Davis, Chair •D. Adamczyk •M. A. Hewson •A. M. Mulcahy •M. A. Weinberger Independence •Each member of the Committee is independent and has significant experience in positions requiring financial knowledge and analysis. Committee Financial Expert •D. S. Davis | | | | | |

| | | | | | | | | | | | | | | | Compensation & Benefits Committee | Roles and responsibilities •Establishes our executive compensation philosophy and principles. •Reviews and recommends for approval by the independent Directors the compensation for our CEO and approves the compensation for our other executive officers. •Sets the composition of the group of peer companies used for comparison of executive compensation. •Oversees the design and management of the various pension, long-term incentive, savings, health and benefit plans that cover our employees. •Reviews the compensation for our non-employee Directors and recommends compensation for approval by the Board. •Provides oversight of the compensation philosophy and policies of the Management Compensation Committee, a non-Board committee composed of Mr. Duato (Chairman and CEO), Mr. Wolk (Executive Vice President, Chief Financial Officer) and Dr. Fasolo (Executive Vice President, Chief Human Resources Officer), which, under delegation from the Compensation & Benefits Committee, determines management compensation and establishes perquisites and other compensation policies for employees other than our executive officers. The Compensation & Benefits Committee has retained Semler Brossy Consulting Group as its independent compensation consultant for matters related to executive officer and non-employee Director compensation. For further discussion of the role of the Compensation & Benefits Committee in the executive compensation decision-making process and a description of the nature and scope of the consultant’s assignment, see Governance of Executive Compensation on page 78. * Includes one joint meeting with the Audit Committee. | | | | 7* Meetings in 2023 | | | | Members •M. A. Hewson, Chair •D. Adamczyk •D. S. Davis •H. Joly Independence •Each member of the Committee is independent. | | | | | |

| | | | | | | | | | | | | | | | Nominating & Corporate Governance Committee | Roles and responsibilities •Oversees matters of corporate governance, including the evaluation

of the policies and practices of the Board and the Board leadership structure. •Oversees the process for performance evaluations of the Board and

its committees. •Reviews key talent metrics for the overall workforce. •Evaluates any questions of possible conflicts of interest for the Board and Executive Committee members. •Reviews potential candidates for the Board as discussed on page 13 and recommends Director nominees to the Board for approval. •Reviews and recommends Director orientation and continuing education programs for Board members. •Oversees compliance with the Code of Business Conduct & Ethics for members of the Board of Directors and executive officers. •Evaluates the Board leadership structure on an annual basis. | | | | 4 Meetings in 2023 | | | | Members •A. M. Mulcahy, Chair •J. A. Doudna •P. A. Johnson •H. Joly Independence •Each member of the Committee is independent. | | | |

Dear Fellow Shareholders: | | | | | | | | | | | | | | | | Regulatory Compliance & Sustainability Committee | Roles and responsibilities Despite continued COVID-19•Oversees regulatory compliance and adherence to high standards of quality in the areas of healthcare compliance, anti-corruption laws, and the manufacture and supply of products.

•Oversees compliance with applicable laws, regulations and Company policies related challenges,to supply chain, product quality, environmental regulations, employee health and safety, healthcare compliance, privacy, cybersecurity and political expenditures. •Reviews the policies, practices and priorities for our political expenditures and lobbying activities. •Oversees our risk management programs, including those related to global cybersecurity, information security, product quality and technology •Reviews with management all significant litigation, investigations and complaints involving healthcare compliance, anti-corruption laws and product quality compliance. •Reviews and discusses with management the progress of sustainability goals and objectives within the Company, delivered strong resultsand external industry benchmarks and practices in 2021. the area of ESG/sustainability. * Includes one joint meeting with the Audit Committee. | | | | 5* Meetings in 2023 | | | | Members •M. A. Weinberger, Chair •M. C. Beckerle •M. B. McClellan •N. Y. West Independence •Each member of the Committee is independent. | | | |

| | | | | | | | | | | | | | | | Science & Technology Committee | Roles and responsibilities •Monitors and reviews the overall strategy, direction and effectiveness of the research and development organizations supporting our businesses. •Assists the Board in identifying and comprehending significant emerging science and technology policy and public health issues and trends that may impact the Company's overall business strategy. •Assists the Board in its oversight of major acquisitions and business development activities as they relate to new science or technology. •Serves as a resource and provides input as needed regarding the scientific and technological aspects of product-safety matters. | | | | 4 Meetings in 2023 | | | | Members •M. C. Beckerle, Chair •J. A. Doudna •M. B. McClellan •N. Y. West Independence •Each member of the Committee is independent. | | | |

| | | | | | | | | | | | | | | | Finance Committee | •Composed of the Chairman and CEO and Lead Director. •Exercises the authority of the Board during the intervals between Board meetings, as permitted by law and our By‑Laws. •Acts between Board meetings as needed, generally by unanimous written consent in lieu of a meeting. •Any action is taken pursuant to specific advance delegation by the Board or is later ratified by the Board. | | | | | |

Board meetings and processes Director meetings and attendance During 2023, the Board and its committees continued their schedules of regular meetings, holding both virtual and in-person meetings. The Board held 15 meetings in 2023. Each Director attended at least 75% of the regularly scheduled and special meetings of the Board and the committees on which he or she served (during the period that he or she served). It has been our longstanding practice for all Director nominees to attend the Annual Meeting of Shareholders. All of the Director nominees attended the 2023 Annual Meeting, which was held virtually. Executive sessions During 2023, each of the Audit, Compensation & Benefits, Nominating & Corporate Governance, Regulatory Compliance & Sustainability and Science & Technology Committees met in executive sessions without members of management present. The independent Directors met in executive session at every regular Board meeting during 2023 and held an additional special executive session to perform the annual evaluation of the Chairman and CEO. The Lead Director acted as chair at all of these executive sessions. Private committee sessions with key compliance leaders In addition to meeting in executive session, the Audit Committee, the Science & Technology Committee and the Regulatory Compliance & Sustainability Committee held regularly scheduled private sessions with their respective compliance leaders (e.g., the Chief Audit Executive, the Chief Compliance Officer, the Chief Financial Officer, the Chief Quality Officer, the Chief Medical Officer and the General Counsel) in committee meetings during 2023, without the Chairman and CEO present. These private sessions allow the independent Directors to engage in informal discussions with management and provide the opportunity to solicit candid feedback and insights on risks, controls and compliance matters.

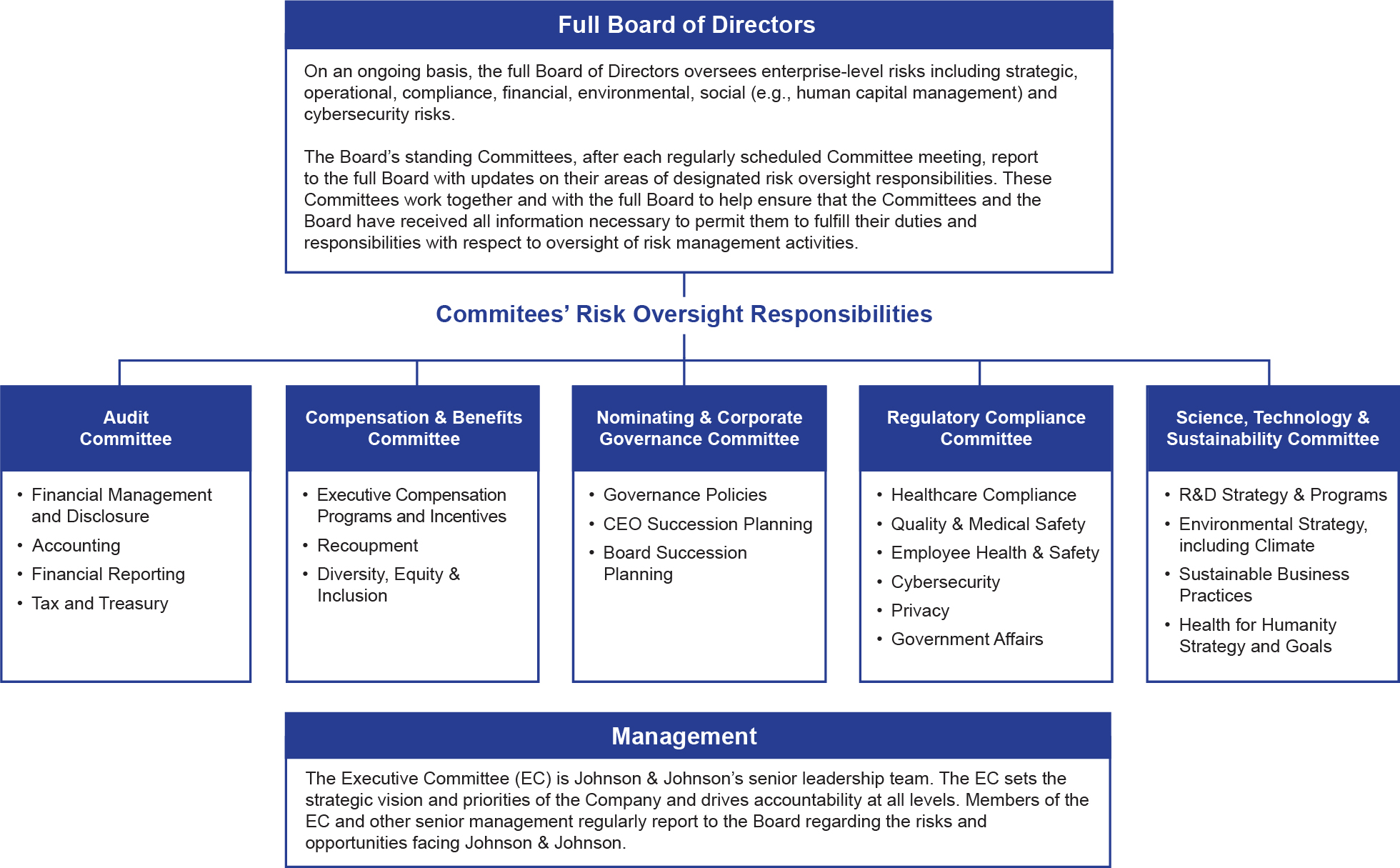

Oversight of our Company Strategy and risk Board oversight of strategy and risk management Oversight of the Company's corporate strategy and risk management is one of the Board's primary responsibilities. The Directors bring diverse perspectives, expertise in strategy and risk and experience in a wide range of industry, scientific, healthcare and regulatory areas relevant to our business, allowing them to provide guidance and effectively evaluate Company strategy. Good governance is a key component of the Board’s oversight responsibilities. In addition to sessions with management, independent Directors hold regularly scheduled executive sessions without management present to discuss Company performance, long-term strategy and risk oversight. Certain committees also meet in private session with senior management in our financial, legal, compliance, quality and risk functions. The Board consults with external advisors to understand outside perspectives on the risks and opportunities facing our Company and regularly reviews feedback provided by shareholders to ensure that it understands their perspectives and concerns. Please see pages 44 - 45 for more information on Shareholder Engagement. Board oversight of strategy Board oversight of strategy helps ensure the Company's long-term success. The Board actively engages with management to provide effective oversight of and guidance on our short- and long-term strategies and has developed effective practices to execute its oversight responsibilities, including in the following ways: •The Board conducts an extensive review of the Company's long-term strategic plans on an annual basis. The Board also reviews the long-term strategic plans of each business segment. •Throughout the year, the Board reviews and discusses matters related to the Company's strategy with senior management to ensure our business activities are aligned with our short- and long-term strategy and that we are making progress toward our strategic goals. •The Board regularly reviews global economic, geopolitical, social, industry and regulatory trends and the competitive environment. The Board also considers feedback from our shareholders and other stakeholders to ensure that our short- and long-term strategies are appropriately designed to promote sustainable growth. The Board’s oversight of strategy is enhanced by periodic engagements held outside the boardroom. Most years, independent Directors visit our business locations and research and development facilities around the globe to observe the implementation of our strategy. The Directors engage with senior leaders and employees at these sites to deepen their understanding of our businesses, their varying competitive environments and our corporate culture. Board oversight of risk management Board oversight of risk management is focused on ensuring that senior management has processes and controls in place to appropriately identify and manage risk. The Board actively engages with senior management to understand and oversee our most significant risks, including in the following ways: •The Board reviews strategic, operational, financial reporting, compliance, environmental, social (e.g., human capital management) and cybersecurity risks, leveraging the Company’s Enterprise Risk Management (ERM) framework, which is described in further detail in the pages that follow. •Throughout the year, the Board and relevant committees receive updates from management regarding various ERM issues and risks related to our business segments, including those related to litigation, product quality and safety, cybersecurity, reputation, human capital and business performance.

| | | | | Board of Directors | | | | On an ongoing basis, the Board oversees enterprise-level risks including strategic, operational, compliance, financial, ESG and cybersecurity risks. After each regularly scheduled committee meeting, the Board's standing committees report to the Board on their areas of designated risk and opportunity oversight responsibilities. The committees work together and with the Board to ensure that the committees and the Board receive all information necessary to fulfill their risk-management oversight responsibilities. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Committees | | | | | | | | | | | | | Audit Committee | | | | Nominating & Corporate Governance Committee | | | | | •Financial management and disclosure •Accounting •Financial reporting •Tax and treasury | | | | •Governance policies •CEO succession planning •Board succession planning •Talent management •Diversity, equity and inclusion | | | | | | | | | | | | | Compensation & Benefits Committee | | | | | | | | | | | | | | | | | Regulatory Compliance & Sustainability Committee | | | | | •Executive compensation programs and incentives •Recoupment •Employee engagement and culture •Pay equity | | | | | | | | | •Healthcare compliance •Product quality •Cybersecurity •Government affairs •Privacy •Sustainability and environmental regulation •Human rights | | | | | | | | | | | | | Science & Technology Committee | | | | | | | | •R&D strategy and programs •Scientific and technological innovation •Medical safety •Mergers, acquisitions and investments | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Management | | | | The Executive Committee (EC) is Johnson & Johnson's senior leadership team. The EC sets the strategy and priorities of the Company and drives accountability at all levels. Members of the EC and other senior management regularly report to the Board regarding the Company's risks and opportunities. | |

Enterprise risk management Effective risk management is foundational to our success. To operate responsibly as a Company for the long term, we must balance opportunity and appropriate risk to innovate and positively impact more patients. This includes living into our commitments to ethical behavior, operating with integrity and complying with laws, rules, regulations and policies that reinforce such behavior. Effectively identifying and mitigating risks requires strong collaboration between management and employees responsible for our operations and our functional risk experts responsible for helping to ensure that we operate in a compliant manner. Enterprise risk management framework Our approach to risk management begins with Our Credo values, is enabled by our organizational structure, and is guided by our Enterprise Risk Management (ERM) Framework. During 2023, the Board partnered with management to evolve our ERM framework, processes and procedures. The refreshed ERM Framework provides a coordinated, integrated and aggregated process for managing risks across the Enterprise. The ERM Framework helps identify potential events that may affect the Company, manage the associated risks and opportunities, and provide reasonable assurance that our objectives will be achieved. Our ERM Framework is composed of five integrated components: •Strategy and objectives •Governance and oversight •Risk identification and prioritization •Risk management and monitoring •Information, communication and reporting For more information about the Company's ERM Framework, please see www.jnj.com/about-jnj/enterprise-risk-management-framework. The Enterprise Compliance Risk Committee (ECRC), comprising cross-functional senior leaders with risk management responsibilities, provides governance and oversight over risk management activities across segments and functional teams. The ECRC also serves as a forum for sharing of risk information, risk management coordination, risk decision-making and oversight of response. Patient safety and product quality Patient safety and product quality are core Credo values – they have always been and will remain our first priority. Our functionally independent quality and compliance organization, led by our Chief Quality Officer, implements quality processes and procedures designed to ensure that our products meet our quality standards, which meet or exceed industry requirements. The quality and compliance organization has embarked on a strategy to enhance its digital foundation with a focus on continuous improvements in product quality and customer experience. The organization led several recent improvements in our quality and compliance practices, including transforming quality processes with digital solutions. Accessible and inter-connected data across the quality and compliance organization is at the core of our strategy, allowing for product quality insights that can be designed directly into our new products. You can learn more about our quality processes at healthforhumanityreport.jnj.com/. Our functionally independent medical safety organization, which is led by the Chief Medical Officers in each segment, monitors our products from research and development through clinical trials, as well as pre- and post- regulatory approvals. This team of doctors and scientists prioritizes our patient experience and ensures that safety remains our first consideration in any decision along the value chain. Of note, litigation is sometimes referenced by ratings agencies and other stakeholders as a barometer of quality and safety. There are, however, many factors that contribute to commencement of litigation, many of which are unrelated to product quality or patient safety. Furthermore, jury verdicts are not medical, scientific or regulatory conclusions about our products. When faced with litigation, our approach will depend on the facts and circumstances. We will continue to emphasize the distinction between litigation and quality and product safety where appropriate in our external engagements.

Ethics and compliance Leveraging the Company’s ERM Framework, our independent compliance functions, including legal, healthcare compliance (including anti-bribery and anti-corruption), quality, global audit and assurance, privacy, information security and medical safety, work closely with our business segments to identify risks and advise management as they develop plans to mitigate or manage these risks. Employees of our independent risk functions partner closely with the business segments to provide timely, relevant guidance and are supervised by leadership within their function. This structure, independent of commercial interests, allows our risk functions to escalate concerns and helps to ensure that best practices are being applied across the Enterprise. Our Code of Business Conduct – refreshed and re-launched in 2024 – applies to all our employees around the world as well as identified contingent workers. The refreshed Code of Business Conduct is available in 27 languages and is designed to inform employees and contingent workers of relevant laws, Company policies and ethical standards to help identify risks and ensure compliant practices in every market where we operate. The Code of Business Conduct also provides guidance on where to turn for help and how to escalate risks and concerns. Our management around the globe is trained annually on the requirements of this policy through our compliance certification process, and we act swiftly to review any reported violations of the Code of Business Conduct, Company compliance policies, laws or regulations. All Company employees and contingent workers are required to complete training on the Code of Business Conduct on a biannual basis and all new employees must complete training upon joining the Company. For more information see www.investor.jnj.com/governance/corporate-governance-overview/code-of-business-conduct/. In addition to the escalation procedure described in the Code of Business Conduct, the Company operates an anonymous telephone and online reporting program known as Our Credo Integrity Line that allows employees, business partners, customers, third-party agencies, suppliers and other parties to report potential violations of Company policies, guidelines or applicable law. The Our Credo Integrity Line is available 24 hours a day, 7 days a week in 24 languages and is an integral component of our strong compliance culture. Additionally, employees can report potential violations by telephone, e-mail or in person within their local business segment or to the Company's global internal audit & assurance, healthcare compliance, legal, security or human resources organizations. Cybersecurity Johnson & Johnson is committed to protecting its information assets and business integrity. The Company’s Board of Directors oversees the risk management process, including cybersecurity risks, directly and through its committees. The Regulatory Compliance & Sustainability Committee of the Board is primarily responsible for oversight of risk from cybersecurity threats and oversees compliance with applicable laws, regulations and Company policies. Our information security and risk management (ISRM) organization, led by our Chief Information Security Officer, is responsible for safeguarding the Company’s networks, systems, products and information against evolving cyber threats, including the use of various security tools supporting protection, detection and response capabilities. The Company maintains a cybersecurity incident response plan to help ensure a timely, consistent response to actual or attempted cybersecurity incidents impacting the Company. To ensure continuous evaluation and enhancement of its cybersecurity program, the Company periodically utilizes third-party experts to undertake maturity assessments of the Company’s information security program. The Company also identifies and assesses third-party risks across a wide range of areas, including data security and supply chain, through a structured third-party risk management program. The Company maintains a formal information security training program for all employees that includes training on matters such as phishing and email security best practices. Employees are also required to complete mandatory training on data privacy.

Political spending oversight and disclosure As a leader in the healthcare industry, we are committed to supporting the development of sound health policies. We work with many organizations across the political spectrum on a variety of policy issues related to health and other topics that impact patients, consumers and our Company. As a result of constructive engagement with a number of our institutional investors, we were an early mover on the disclosure of corporate political expenditures and activities, and we have expanded that disclosure over the years as we continue the dialogue with our shareholders on this issue. This year, in response to shareholder interest, we evaluated the congruency between significant trade associations’ positions on several significant issues and those of Johnson & Johnson, and we disclosed the results of that review in our Position on Stakeholder Engagement. The Regulatory Compliance & Sustainability Committee and the Board review our Company’s political contribution and lobbying policies, practices and activities annually. In addition, our Political Action Committee and U.S. corporate political spending is audited biennially by our internal auditors. Disclosure regarding our political activities and expenditures, including the policies and procedures that govern that activity and spending and the Board’s oversight role, are updated semi-annually and can be found at www.investor.jnj.com/political-engagement. Environmental, social and governance (ESG) We believe that sound ESG practices create financial value by building stakeholder trust, driving innovation, mitigating risk, fostering employee engagement and promoting productivity. Moreover, Johnson & Johnson’s size, prominence and depth of expertise provides a powerful platform for advancing progress on some of the most difficult global health challenges. Our ESG strategy focuses our efforts on the areas where we are best positioned to achieve the greatest impact – championing global health equity, empowering our employees and advancing environmental health. Leading with accountability and innovation is foundational to these efforts. This ESG strategy is grounded in Our Credo values, informed by both our Company’s purpose to change the trajectory of health for humanity and the views of our external stakeholders. Governance of ESG Effective governance of ESG matters is the foundation of our ESG strategy, and the Company’s oversight of ESG-related matters starts with the Board. Significant ESG risks are reviewed and evaluated by the Board and its committees as part of their overall ongoing risk oversight of our Company. On a regular basis, the Board and its committees receive briefings on the Company’s ESG strategy, including updates on its ESG priorities, performance and progress. In addition, the Johnson & Johnson Health for Humanity Report is shared with the Regulatory Compliance & Sustainability Committee and the Board prior to publication. Our ERM Framework helps identify potential events that may affect the Company, manage the associated risks and opportunities, and provides reasonable assurance that our objectives will be achieved. The Enterprise Compliance and Risk Committee (ECRC) facilitates end-to-end risk management across our segments and functional teams. In doing so, the ECRC enables sharing of risk and compliance information, including key ESG-related information and drives coordination across the Company. The Company also regularly conducts a Priority Topics Assessment (PTA), which engages internal and external stakeholders to identify and prioritize the ESG topics that are most relevant to our business. We continually enhance the PTA methodology to conduct deeper and broader stakeholder engagement across a larger number of ESG topics. The PTA has occurred every two to three years since 2008. ESG disclosure and reporting Transparent disclosure on our ESG priorities is critical to ensuring that our shareholders have access to useful information regarding our progress. We therefore provide extensive disclosures on our corporate citizenship and sustainability efforts in our annual Health for Humanity Report, available at healthforhumanityreport.jnj.com. We seek to continually evolve our ESG disclosures to meet the expectations of our shareholders and other stakeholders, including the following: •Our Health for Humanity Report provides our ESG strategy and annual progress toward our Health for Humanity goals and commitments. •We disclose against various benchmarks, including the Sustainability Accounting Standards Board (SASB) Standards, CDP Climate, the Task Force on Climate-related Financial Disclosures (TCFD) and the Norges Bank Investment Management anti-corruption indicator framework. •We regularly engage with thought-leaders, ESG-focused investors, standard setters and other stakeholders to improve our disclosures on key ESG topics.

•We are committed to reporting high-quality, validated data and disclose externally assured data in the areas of quality, human capital management, DEI, philanthropy and environmental governance. •To ensure our performance is accurately reflected in various ESG scores, we proactively engage with third-party ESG rating agencies throughout the year. •As part of our Health for Humanity Report, we publicly disclose our U.S. Federal Employer Information Report EEO-1, and we annually publish the Johnson & Johnson Diversity, Equity & Inclusion Impact Review, available at belong.jnj.com/, which examines how the Company’s global DEI strategy is a key driver of innovation and business outcomes. Human capital management Our employees are critical to our continued success and are an essential element of our long-term strategy. With that guiding principle, our human capital management strategy is built on three fundamental focus areas: •Attracting and recruiting the best talent •Developing and retaining talent •Empowering and inspiring talent These focus areas are crucial to all aspects of Johnson & Johnson’s business. The Board and its committees are actively engaged in overseeing the Company’s human capital management strategy, talent development and corporate culture. The Board reviews the Company’s human capital management strategy on an annual basis and receives regular updates throughout the year on key talent metrics for the overall workforce, including those related to DEI, recruiting and talent development. To further develop its understanding of and engagement with the Company’s culture, the Board meets with employees and schedules site visits at our business locations. CEO and management succession planning The Board devotes significant time to leadership development and succession. The Board has primary responsibility for succession planning for the CEO and oversight of succession planning for other executive officers. The Nominating & Corporate Governance Committee oversees the development of succession planning processes and protocols, along with key talent metrics for the overall workforce. The Nominating & Corporate Governance Committee and the Board review succession plans annually for the members of the Executive Committee with the CEO and Chief Human Resources Officer. In addition, high-potential executives meet with the Board in formal and informal settings in order to provide Directors with opportunities to personally assess the leadership pipeline. Compensation and benefits Executive compensation The Board believes that an executive compensation program should align management with shareholders and not incentivize leaders to take excessive risks. When determining executive compensation, the Board reviews our Company’s financial performance as well as other strategic factors, including product quality metrics, talent development, diversity, equity and inclusion, access to medicines, and other ESG goals to ensure our leaders are driving long-term growth in a manner aligned with Our Credo values. For more information regarding our executive compensation philosophy, please see the discussion of our guiding principles on page 64. The Board's Compensation & Benefits Committee (CBC) reviews the performance of our Chairman and CEO and the Executive Committee using the financial and non-financial metrics described in the Compensation and Discussion Analysis (see page 58). The CBC also oversees the design of our executive compensation programs to ensure that the programs do not incentivize our executive officers, either individually or as a group, to make business decisions that could maximize short-term results at the expense of long-term value. The independent Directors who serve on the CBC collaborate with an independent compensation consultant and are informed of our most significant risks, including litigation, drug pricing and product quality.

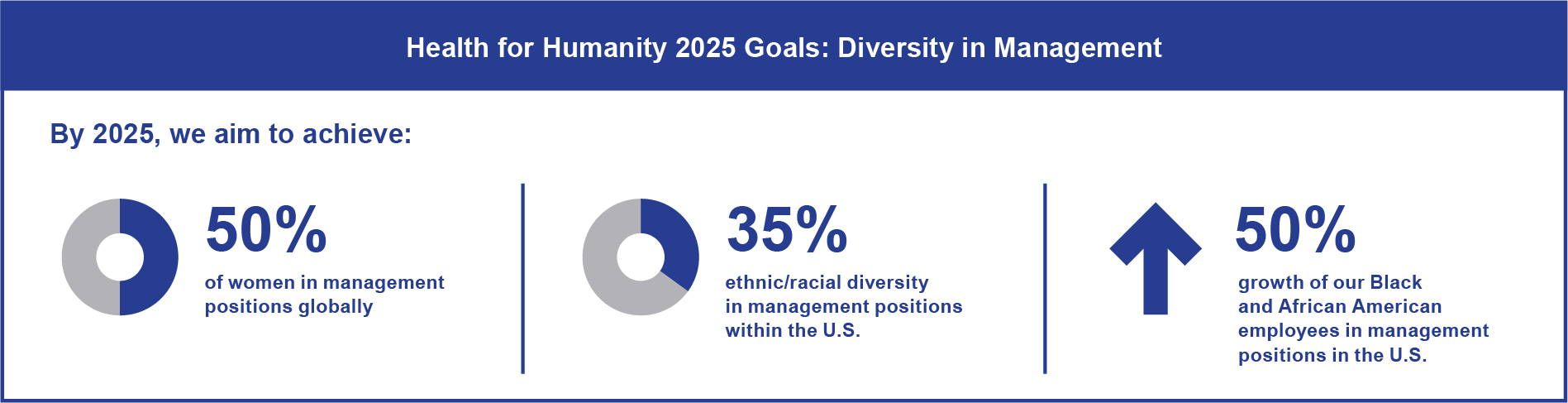

Leaders from our executive compensation team regularly participate in governance engagements with our shareholders. The feedback received is regularly considered in decision-making related to our executive compensation programs. For example, in response to shareholder feedback, the Board has enhanced disclosure and transparency in the Proxy Statement regarding the CBC's consideration of special items, including litigation, and the exercise of discretion with respect to executive compensation determinations. More information on this enhanced disclosure can be found in the Shareholder Feedback section at page 45. Please see the Compensation Discussion and Analysis beginning on page 58 for a complete discussion of our compensation programs. Other compensation and benefits The Compensation & Benefits Committee oversees the design and management of our employee compensation and benefits programs to ensure that the Company’s programs are aligned both to attract global business leaders and to drive long-term, sustainable value creation by reinforcing performance against our long-term financial and strategic objectives. This includes product pipeline and innovation, product quality and safety, technology, talent, DEI and other ESG goals. As part of our total rewards philosophy, we offer competitive compensation and benefits to attract and retain top talent. We are committed to fairness and equitable treatment in our compensation and benefits for employees at all levels. This commitment extends to pay equity, including gender and ethnic/racial group pay equity. From time to time, we analyze our pay across functions and levels, and strive to eliminate unconscious bias or other barriers to full pay equity across the Enterprise. We observe legal minimum wage provisions and exceed them where possible. Our total rewards offerings include an array of programs to support our employees' well-being, including annual performance incentive opportunities, pension and retirement savings programs, health and welfare benefits, paid time off, leave programs, flexible work schedules, employee assistance programs and 12 weeks of paid parental leave for all eligible employees. Growth and development Fostering top talent will always be critical to our success. Our employees must be equipped with the right knowledge and skills and have opportunities to grow and develop in their careers. One advantage for the Company, based on its size and breadth, is the ability to offer increasing levels of responsibility as well as opportunities to move across functions, countries or segments. To support these opportunities, we provide learning and development programs and educational resources to all employees. These range from opportunities to develop and hone leadership skills, training for sharpening current capabilities or acquiring new skills, and expanding networks through collaboration, mentorship or Employee Resource Groups. Our objective is to enable a learning culture that helps shape each person’s unique career path while creating a robust pipeline of talent to deliver on the Company’s long-term strategies. To keep pace with rapidly evolving business and industry needs, we launched J&J Learn, our on-demand global learning and development ecosystem that provides our workforce with continuous opportunities for reskilling and upskilling in key areas such as digital acumen and professional development. Diversity, equity and inclusion (DEI) Enabling employees to perform at their best while being themselves is fundamental to our continued success. We are therefore committed to workplace diversity and to a culture of equity and inclusion. Johnson & Johnson's Enterprise DEI Strategy recognizes how DEI accelerates our ability to meet the needs of the communities we serve and rests on four core pillars: •Accelerate our global culture of inclusion where every individual belongs. •Build a workforce of individuals with diverse backgrounds, abilities, cultures and perspectives. •Drive innovation and growth with our business to serve diverse markets around the world. •Transform talent and business processes to achieve equitable opportunities for all. Our DEI Strategy is guided by internal and external insights, global best practices and employee feedback, which remind us that while diversity varies from one market to another, inclusion is universal. Our DEI efforts involve the highest levels of leadership and cascade across the Enterprise, led by our Chief Diversity, Equity & Inclusion Officer, who reports to our Chief Human Resources Officer and Chairman and CEO. The Chairman and CEO, together with members of the Executive Committee, is briefed on DEI-related matters quarterly, and updates are regularly provided to the Board.

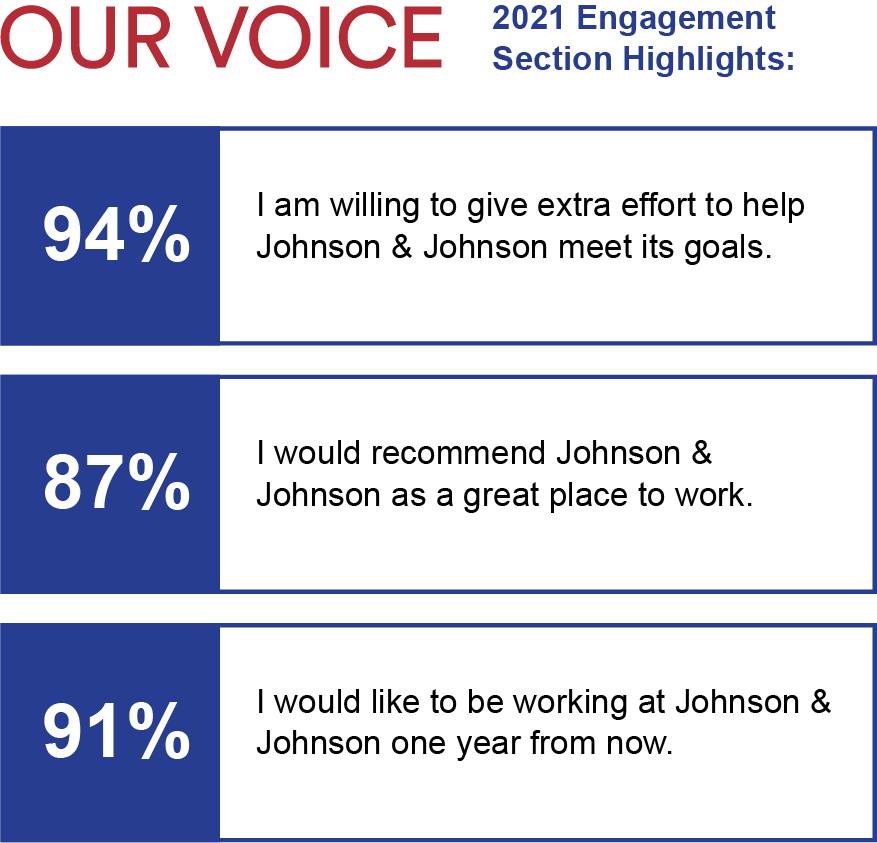

In furtherance of our commitment to DEI, and after reviewing the voting results and listening to views on the related shareholder proposal received in 2022, our Board of Directors has directed the Company to conduct a racial justice audit. The Company has engaged Covington & Burling, a law firm with expertise in the area, to conduct the audit. The audit is well underway, and the Company anticipates that a related report will be released in 2024. Wellness, culture, employee engagement Our investment in employee health, well-being and safety is built on the conviction that advancing health for humanity starts with advancing the health of our employees. With the right awareness, focus, practices and tools, we ensure that all our employees around the world, as well as temporary contractors and visitors to the Company's sites, can work safely. We have continuously expanded health and well-being programs throughout the Company and across the globe, incorporating new thinking and technologies to help employees achieve their personal health goals. The programs and practices we advance for total health – physical, mental, emotional and financial – promote employee health protection for emerging health risks. We conduct global surveys that offer our employees the ability to provide feedback and valuable insight to help address potential human resources risks and identify opportunities to improve. After 80 years, Our Credo continues to stand the test of time, and our dedication to its principles is as strong as ever. Starting in 2023, we combined the Our Credo Survey and the Our Voice Survey – which previously took place in alternating years – into one process. The streamlined survey is focused on the most important questions and issues, and employee responses provide Company leadership with valuable insights that create a work environment that ignites creativity, fosters collaboration and rewards impact – all while maintaining an inclusive culture in which every employee can make a difference. The results of the Our Credo Survey are reviewed by the Board, senior leadership and the human resources organization. Managers are provided with detailed anonymized reports highlighting their team results, along with both strengths and areas where an improvement plan is recommended. Our Credo Survey | | | | | | | | | | | | | 2023 Highlights: | | In the 2023 Our Credo Survey, employees reported they believe management: | | | | | | | 92% | Ensures our first responsibility to the patients, doctors and nurses, mothers and fathers, and all others who use our products and services. | | | | | 85% | Provides an inclusive environment where each employee is considered as an individual. | | | | | 92% | Is committed to our stockholders. | | | |

In addition to our formal global employee survey, we conduct targeted employee sentiment “pulse” surveys to gather feedback on several topics, including engagement, organizational support, and awareness and availability of resources. These surveys further inform how we can support our employees. For more information on the Company's approach to human capital management, talent development and employee engagement, please see healthforhumanityreport.jnj.com/.

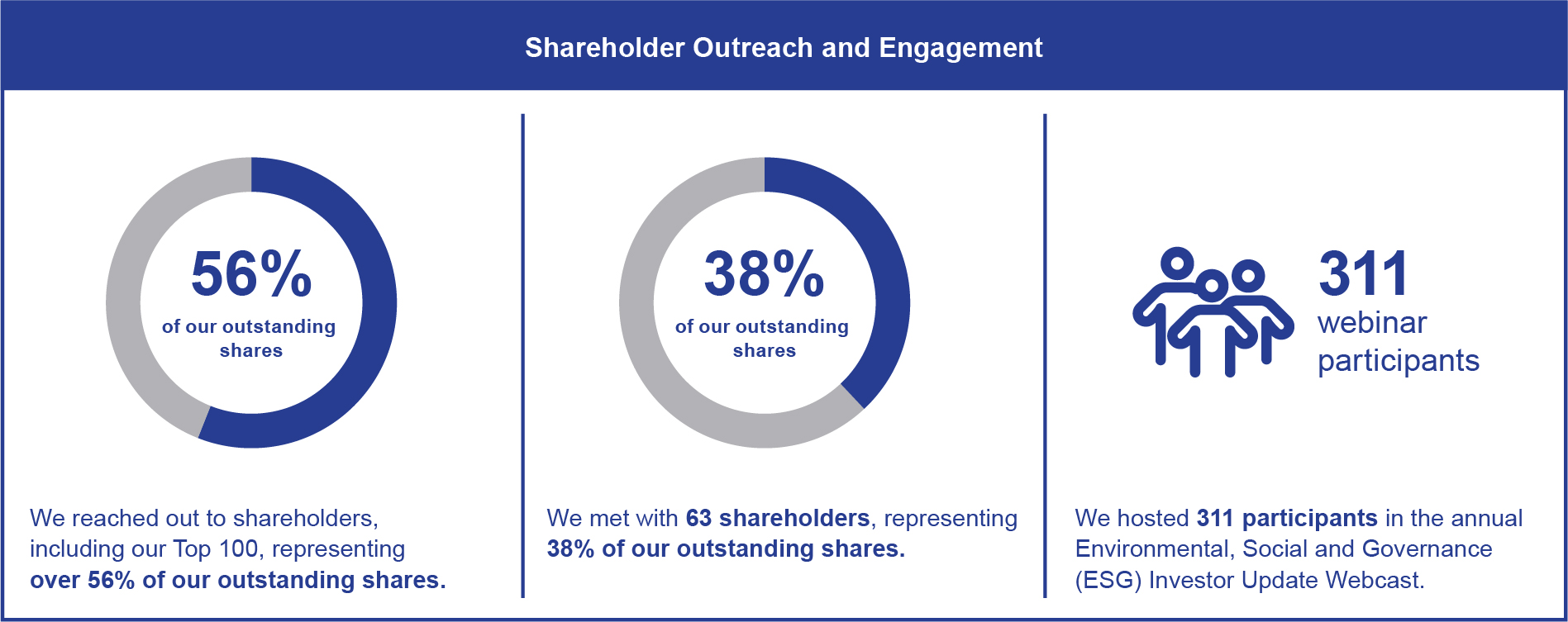

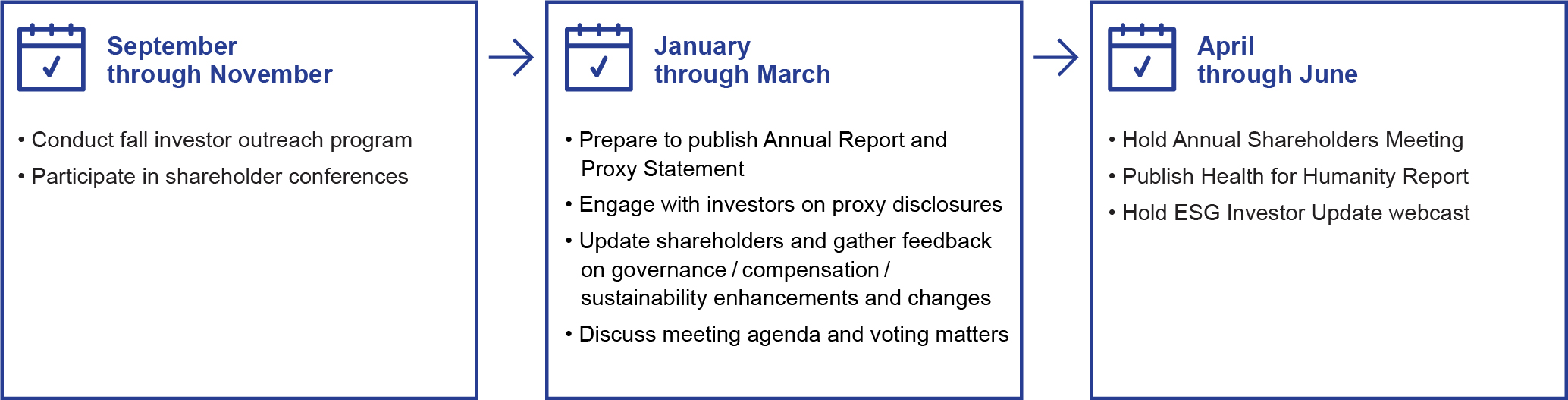

Shareholder engagement Our responsibility to shareholders is one of our core Credo values. The Board and management prioritize building and maintaining meaningful relationships with Company shareholders, including understanding and learning from their viewpoints. The Board is regularly briefed on shareholder feedback, which in turn informs Board discussions on a wide range of topics. Our Board also values directly engaging with our stakeholders, and in 2023, our Lead Director and the Chair of the Compensation & Benefits Committee personally led engagements with many of our largest shareholders and other interested stakeholders. Our shareholder engagement cycle We maintain active shareholder outreach and engagement throughout the year, offering a continuous cycle of feedback and response. In early summer, we review the voting results from the prior Annual Shareholders’ Meeting, Company performance and emerging topics of shareholder interest. We develop a shareholder outreach and engagement plan for the fall and review it with external advisors to ensure that our program is focused on topics of greatest interest to our shareholders. In the spring, we again meet with shareholders, with a particular focus on the upcoming Annual Shareholders’ Meeting and related voting matters, our voluntary reporting in the Health for Humanity Report and any planned disclosure or governance changes in response to shareholder feedback. Prior to the Annual Meeting and then again in the fall, we reach out to our Top 100 largest shareholders and other stakeholders to discuss and receive feedback on governance items of interest. In 2023, we reached out to shareholders representing approximately 52% of our outstanding shares and met with approximately 48 U.S. and international shareholders representing 38% of our outstanding shares. Throughout the year, we also receive and respond to shareholder inquiries and requests submitted to the Board and the Company. Shareholders may contact the Board, our Lead Director or the Company as further described on page 134. 2023 Engagement initiatives Reflecting the global nature of our business and shareholders, in 2023 the engagement team traveled to Europe to meet with institutional investors and stakeholders based in Amsterdam and London, providing an opportunity for in-depth discussion of topics of particular significance to our Europe-based investors. In December 2023, we conducted our first ever enterprise-wide business review, which highlighted J&J's overarching strategy and ability to execute on long-term commitments. The event involved more than 200 in-person attendees and 3,000 virtual participants who heard directly from Company leadership about the strength of J&J's business, its long-term financial outlook, and the diverse and robust Innovative Medicine and MedTech pipelines. | | | | | | | | | | | | | 2023 Highlights | | | | | | 52% of our outstanding shares | | 38% of our outstanding shares | | | | | | | We rolledreached out to shareholders representing approximately 52% of our vaccine globally,outstanding shares. | We engaged with commitmentsapproximately 48 U.S. and international institutional shareholders representing approximately 38% of our outstanding shares. | | | | |

| | | | | | | | | | | | | | | | Shareholder engagement topics | | Our core shareholder engagement team is comprised of Company personnel with varied areas of expertise, including governance and ESG, financial performance and executive compensation. For each engagement, we supplement our core team as needed to equitably supplyhave the world’sright personnel available for an informed, meaningful discussion on the topics that are most vulnerable populations. We had robust top-important to each respective investor. Our 2023 governance engagements covered a wide range of important corporate governance, environmental and bottom-line growth,social stewardship, compensation and public policy issues, including the following (listed in alphabetical order): | | | | | •Biodiversity and deforestation •Board composition •Board oversight of risk •Board tenure and refreshment •Consumer Health separation •Culture and human capital management •Diversity, equity and inclusion •ESG matters and reporting •Executive compensation and performance metrics | •Lead Director responsibilities •Litigation •Pharmaceutical pricing transparency and access •Product quality and safety •Separation of the Chairman and CEO roles •Shareholder engagement and communication •Shareholder proposals •Succession planning and talent development •Tax policy | | | | |

| | | | | | | | | | | | | | | | Shareholder feedback and response | | The following table highlights several areas where our shareholders provided feedback and how the Company responded. | | What we increased our dividendheard | What we did | | Shareholders voiced broad support for the 59th consecutive year. Our pipeline growth was also strong,fundamentals of our executive compensation program and ourexpressed an interest in continued investmentfocus on transparency around the treatment of significant litigation costs. | Committed to ongoing transparency and disclosure around the treatment of significant litigation costs in R&Dexecutive compensation as further described on page 62 of the Compensation Discussion and innovation will propelAnalysis. This commitment led to the withdrawal of a shareholder proposal on this topic during the 2023 Proxy season. | | | Interest in the Company’s long-term success. The plannedapproach to risk management, particularly in light of the separation of the Consumer Health business will allowbusiness. | Directed by the twoBoard, the Company evolved its Enterprise Risk Management approach offering an updated and integrated, comprehensive management of risk across the Enterprise. More detail on this approach can be found at page 38. | | | Positive feedback on the Company’s disclosures with an interest in further tailoring and streamlining to clarify the Company’s key priorities as a new companiestwo-segment company. | Focused disclosure efforts in this Proxy Statement on efficiency in goal setting and streamlining of reporting to harness growth opportunitiesprovide the most relevant information in a user-friendly manner. We anticipate similar reforms in our forthcoming Health for Humanity Report and unlock value.future reports and disclosures. | | | Interest in the Company’s approach to consideration of policy alignment with partner trade associations. | Enhanced disclosure provided in our public Position on Stakeholder Engagement now includes a congruency analysis. | | | | |

Our 2021 Say on Pay vote won majority support at 57%. We discussed the vote result with our shareholders, considered the rationale for why we exclude special items from non-GAAP EPS and their impact on our long-term equity compensation, and enhanced our process for reviewing and considering items excluded from non-GAAP performance measures. We articulated the factors we consider in determining whether to adjust incentive payouts. For 2021 and prior years, we determined that no adjustments to incentive plan results were warranted,

Related person transactions and Director independence Related person transactions Our Policy on Transactions with Related Persons requires the approval or ratification by the Nominating & Corporate Governance Committee of any transaction or series of transactions exceeding $120,000 in which our Company is a participant and any related person has a direct or indirect material interest (other than solely as a result of being a director or trustee or less than 10% owner of another entity). Related persons include our Directors and executive officers and their immediate family members and persons sharing their households. It also includes persons controlling more than 5% of our outstanding common stock. Under our Principles of Corporate Governance and Code of Business Conduct & Ethics for Members of the Board of Directors and executive officers, all our Directors and executive officers have a duty to report to the Chairman and CEO or the Lead Director any potential conflicts of interest, including transactions with related persons. Management also has established procedures for monitoring transactions that could be subject to approval or ratification under the Policy on Transactions with Related Persons, which can be found at www.investor.jnj.com/corporate-governance. Once a related person transaction has been identified, the Nominating & Corporate Governance Committee will review all of the relevant facts and circumstances and approve or disapprove entry into the transaction. The Committee will take into account, among other factors, whether the transaction is on terms no more favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction. If advance Committee approval of a transaction is not feasible, the transaction will be considered for ratification at the Committee’s next regularly scheduled meeting. If a transaction relates to a member of the Committee, that member will not participate in the Committee’s deliberations. In addition, the Committee Chair (or, if the transaction relates to the Committee Chair, the Lead Director) may pre-approve or ratify any related person transactions involving up to $1 million. The following types of transactions have been deemed by the Committee to be pre-approved or ratified, even if the aggregate amount involved will exceed $120,000: •Compensation paid by our Company for service as a director or executive officer. •Transactions with other companies where the related person’s only relationship is as a non-executive employee, less than 10% equity owner or limited partner, and the transaction does not exceed the greater of $1 million or 2% of that company’s annual revenues. •Our contributions to charitable organizations where the related person is an employee and the transaction does not exceed the lesser of $500,000 or 2% of the charitable organization’s annual receipts. •Transactions where the related person’s only interest is as a holder of our stock and all holders receive proportional benefits, such as the payment of regular quarterly dividends. •Transactions involving competitive bids. •Transactions where the rates or charges are regulated by law or government authority. •Transactions involving bank depositary, transfer agent, registrar, trustee under a trust indenture or a party performing similar banking services. Transactions with related persons in 2023 A sister of Mr. Wolk, Executive Vice President, Chief Financial Officer, is a Mobility Operations Leader at Johnson & Johnson Services, Inc., a wholly-owned subsidiary of the Company, and earned $209,351 in total compensation in 2023, including base salary, any annual incentive bonus, the value of any long-term incentive award granted in 2023 and any other compensation. She also participates in the general welfare and benefit plans of Johnson & Johnson Services, Inc. Her compensation was established in accordance with Johnson & Johnson Services, Inc.’s employment and compensation practices applicable to employees with equivalent qualifications and responsibilities and holding similar positions. Mr. Wolk does not have a material interest in his sister’s employment, nor does he share a household with her.

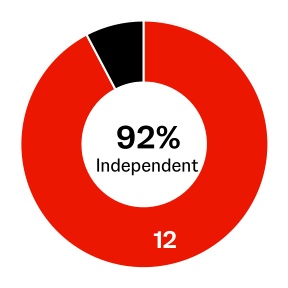

Ms. Kathryn Wengel is Executive Vice President, Chief Technical Operations & Risk Officer. Ms. Wengel’s brother-in-law is a partner at the law firm of Nelson Mullins Riley & Scarborough LLP (Nelson Mullins). The Company has engaged Nelson Mullins for more than twenty years. In 2023, the Company paid approximately $16 million to Nelson Mullins for legal services. Ms. Wengel's brother-in-law did not bill any services to Johnson & Johnson in 2023. Ms. Wengel had no involvement with respect to the retention of, or payments to, Nelson Mullins. Additional related person transactions that occurred in 2023 are disclosed in the following table "Director independence analysis and related person transactions”. These transactions were approved by the Nominating & Corporate Governance Committee in compliance with our Policy on Transactions with Related Persons described above. Director independence | | |  All Directors are independent except for our Chairman and CEO All Directors are independent except for our Chairman and CEO |

It is our goal that at least two-thirds of our Directors be independent, not only as that term may be defined legally or mandated by the New York Stock Exchange (NYSE), but also without the appearance of any conflict in serving as an independent Director. The Board has determined that all non-employee Directors who served during fiscal 2023 were independent under the listing standards of the NYSE and our Standards of Independence, including: Mr. Adamczyk, Dr. Beckerle, Mr. D. S. Davis, Mr. I. Davis, Dr. Doudna, Ms. Hewson, Dr. Johnson, Mr. Joly, Dr. McClellan, Ms. Mulcahy, Dr. Washington, Mr. Weinberger, Dr. West and Mr. Woods. To assist the Board in making this determination, the Board adopted Standards of Independence as part of our Principles of Corporate Governance, which can be found at www.investor.jnj.com/corporate-governance. These Standards conform to, or are stricter than, the NYSE independence standards and identify, among other things, material business, charitable and other relationships that could interfere with a Director’s ability to exercise independent judgment. As highly accomplished individuals in their respective industries, fields and communities, the non-employee Directors are affiliated with numerous corporations, educational institutions, hospitals and charities, as well as civic organizations and professional associations, many of which have business, charitable or other relationships with our Company. The Board considered each of these relationships in light of our Standards of Independence and determined that none of these relationships conflict with our interests or would impair the relevant non-employee Director's independence or judgment. The table on the following page describes the relationships that were considered in making this determination, inclusive of any related person transactions. The nature of the transactions and relationships summarized in the following table, and the role of each of the Directors at their respective organizations, were such that none of the non-employee Directors had any direct business relationships with our Company in 2023 or received any direct personal benefit from any of these transactions or relationships. All of the transactions and relationships of the type listed were entered into, and payments were made or received, by our Company or one of our subsidiaries in the ordinary course of business and on competitive terms. In 2021, 2022 and 2023, our transactions with or discretionary charitable contributions to each of the relevant organizations (not including gifts made under our matching gifts program) did not exceed the greater of $1 million or 1% of that organization’s consolidated gross revenues and, therefore, did not exceed the thresholds in our Standards of Independence. | | | | | In the event of Board-level discussions pertaining to a potential transaction or relationship involving an organization with which a Director is affiliated, that Director would be expected to recuse himself or herself from the deliberation and decision-making process. In addition, other than potential review and approval of related person transactions under our Policy on Transactions with Related Persons described on the following page, none of the non-employee Directors has the authority to review, approve or deny any grant to or research contract with an organization. | |

Director independence analysis and related person transactions | | | | | | | | | | | | | | | | | | | Organization | Type of

organization | Director | Relationship to

organization | Type of

transaction or

relationship | 2023

Aggregate

magnitude | Honeywell International1 | Profit organization | D. Adamczyk | Executive Officer | General building services and maintenance | <1% | Huntsman Cancer Institute2 | Healthcare

institution | M. C. Beckerle | Executive

Officer | Clinical research; investigator payments | <1% <$1m | | University of Utah | Educational

institution | M. C. Beckerle | Employee | Sales | <1% | | Investigator payments; grants | <1% <$1m | | University of California - Berkeley | Educational institution | J. A. Doudna | Employee | Charitable contributions | <1% <$1m | | Sales | <1% | | Research-related payments; sponsorships; grants | <1% <$1m | Wellesley College3 | Educational institution | P. A. Johnson | Executive Officer | Royalties | <1% <$1m | | Harvard Business School | Educational institution | H. Joly | Employee | Charitable contributions | <1% | | Grants; rental payments; rebates; consulting fees; lab supplies; tuition; training programs; memberships; subscriptions | <1% <$1m | | Save the Children | Non-Profit organization | A. M. Mulcahy | Trustee | Contributions | <1% <$1m | | Dell Medical School (University of Texas) | Educational institution | M. B. McClellan | Employee | Sales | <1% | | Charitable contributions; grants | <1% <$1m | | Duke University | Educational

institution | M. B. McClellan | Employee | Sales | <1% | | Charitable contributions; grants | <1% <$1m | | | Research-related payments; tuition reimbursements | <1% | | | Americares | Non-profit organization | N. Y. West | Trustee | Grants; contributions | <1% | | Smithsonian National Museum of African American History and Culture | Non-profit organization | N. Y. West | Trustee | Charitable contributions | <1% <$1m | Advocate Health4 | Profit organization | E. A. Woods | Executive Officer | Sales | <1% |

Note: Any transaction or relationship under $120,000 is not listed above. (1)The Company made payments to Honeywell International, Inc. of approximately $9.06 million relating to general building services and maintenance. (2)The Company made payments to Huntsman Cancer Institute of approximately $962,000 related to clinical research and investigator payments. (3)The Company made payments to Wellesley College of approximately $535,000 relating to royalties owed in connection with the Company's former Consumer Health business prior to the completion of the separation. (4)The Company made payments to Advocate Health of approximately $485,000 in connection with clinical trials; Advocate Health made payments to the Company of approximately $210.5 million relating to sales of the Company's products in the ordinary course of business.

Director compensation The Compensation & Benefits Committee charter requires annual review of non-employee Director compensation, including total compensation and each element of our non-employee Director compensation program. During its annual review, the Committee analyzes the competitive position of our non-employee Director compensation program and each element of that program against the programs of the peer group used for executive compensation purposes (see page 79 for information about the executive peer group). Semler Brossy Consulting Group, the Committee’s independent consultant, provides an independent assessment of the competitive data provided to the Committee and advises the Committee on non-employee Director compensation. Decisions regarding the non-employee Director compensation program are approved by the Board based on recommendations by the Committee. Fiscal 2024 non-employee Director compensation The Compensation & Benefits Committee’s analysis in 2023 of the competitive position of our non-employee Director compensation program showed that overall compensation for non-employee Directors was below peer group median. As a result, the Committee recommended, and the Board approved on September 12, 2023, an increase to the non-employee Director compensation program for 2024. 2024 Non-employee Director compensation The following non-employee Director compensation program for 2024 continues an overall compensation structure in line with the peer group median. | | | | | | | | | | | | Cash compensation | | $125,000 | | Lead Director cash retainer | | 50,000 | | Audit Committee Chair cash retainer | | 30,000 | | Committee Chair (other than Audit) cash retainer | | 25,000 | | Value of Deferred Share Units | | 205,000 |

Fiscal 2023 non-employee Director compensation On September 13, 2022, the Compensation & Benefits Committee recommended, and the Board approved, no changes to the non-employee Director compensation program for 2023. The overall 2023 compensation structure was approximately at peer group median.

2023 total Director compensation This table sets forth the compensation of our Directors for fiscal 2023. For a complete understanding of the table, please read the accompanying footnotes and the narrative disclosures. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | A | B | C | D | E | F | | Name | Role for additional cash retainer | Fees earned or paid in cash | Stock awards | All other compensation | | Total | | D. Adamczyk | | | $125,000 | | $195,000 | | $20,000 | | $340,000 | | M. C. Beckerle | Comm Chair | | 145,000 | | 195,000 | | 15,000 | | 355,000 | | D. S. Davis | Comm Chair | | 155,000 | | 195,000 | | 0 | | 350,000 | | I. E. L. Davis | | | 72,688 | | 0 | | 0 | | 72,688 | | J. A. Doudna | | | 125,000 | | 195,000 | | 0 | | 320,000 | | M. A. Hewson | Comm Chair | | 145,000 | | 195,000 | | 20,000 | | 360,000 | | P. A. Johnson | | | 109,503 | | 233,466 | | 10,000 | | 352,969 | | H. Joly | | | 125,000 | | 195,000 | | 0 | | 320,000 | | M. B. McClellan | | | 125,000 | | 195,000 | | 0 | | 320,000 | | A. M. Mulcahy | LD/Comm Chair | | 195,000 | | 195,000 | | 20,000 | | 410,000 | | A. E. Washington | | | 105,154 | | 0 | | 0 | | 105,154 | | M. A. Weinberger | Comm Chair | | 145,000 | | 195,000 | | 0 | | 340,000 | | N. Y. West | | | 125,000 | | 195,000 | | 20,000 | | 340,000 | | E. A. Woods | | | 10,616 | | 78,534 | | 0 | | 89,150 |

Fees earned or paid in cash (Column C) Elective fee deferrals. As described below, under the Deferred Fee Plan for Directors, non-employee Directors may elect to defer payment of all or a portion of their cash retainers until termination of Board membership. Ms. Hewson, Dr. Washington and Mr. Woods elected to defer all of the cash retainer earned by each of them during fiscal 2023. Stock awards (Column D) For the non-employee Directors: Deferred Share Units - mandatory deferral. All figures in column D represent the grant-date fair value computed in accordance with FASB ASC Topic 718 of Deferred Share Units (DSUs) granted to each non-employee Director on April 27, 2023. The Board approved a 2023 DSU award valued at $195,000; therefore, pursuant to the terms of the Deferred Fee Plan for Directors, each non-employee Director (other than Dr. Johnson, Mr. I. E. L. Davis, Dr. Washington and Mr. Woods) was granted 1,193.975 DSUs. Dr. Johnson was granted 1,429.5 DSUs to account for two additional months of service in 2023. Mr. I. E. L. Davis and Dr. Washington received a one-time cash payment equal to the pro rata amount of the equity award for fiscal year 2023. The pro rata fees and awards earned related to Mr. Woods' time served in 2023 are included in the chart above and the related DSUs will be credited to his account in the first quarter of 2024. DSUs are immediately vested but must be deferred until termination of Board membership. DSUs earn additional amounts based on a hypothetical investment in our common stock, including accruing dividend equivalents in the same amount and at the same time as dividends paid on our common stock. DSUs are settled in cash upon termination of Board membership. All other compensation (Column E) For the non-employee Directors: charitable matching contributions. The amounts reported in column E represent the aggregate dollar amount for each non-employee Director for charitable matching contributions. Non-employee Directors are eligible to participate in our charitable matching gift program on the same basis as employees, pursuant to which we contribute, on a two-to-one basis for every dollar donated, up to $20,000 per year per person to certain charitable institutions.

Director compensation policies and practices Deferred fee plan for Directors Elective fee deferrals. Under the Deferred Fee Plan for Directors, non-employee Directors may elect to defer payment of all or a portion of their cash retainers until termination of Board membership. Deferred fees are converted into DSUs and earn additional amounts based on a hypothetical investment in our common stock, including accruing dividend equivalents in the same amount and at the same time as dividends paid on our common stock. DSUs are settled in cash upon termination of Board membership. Ms. Hewson, Dr. Washington and Mr. Woods elected to defer all of the cash retainer earned by each of them during fiscal 2023. All DSUs earned by Mr. Woods in 2023 will be credited to his account in the first quarter of 2024. Deferred compensation balances. At December 31, 2023, the aggregate number of DSUs held in each non-employee Director’s Deferred Fee Account, including mandatory deferrals, any elective fee deferrals and accrued dividend equivalents, was as follows: | | | | | | | Name | Deferred share units

(#) | | D. Adamczyk | 2,309 | | M. C. Beckerle | 12,166 | | D. S. Davis | 14,112 | | J. A. Doudna | 6,646 | | M. A. Hewson | 8,489 | | P. A. Johnson | 1,461 | | H. Joly | 5,040 | | M. B. McClellan | 16,360 | | A. M. Mulcahy | 19,936 | | M. A. Weinberger | 7,686 | | N. Y. West | 3,680 | | E. A. Woods | 0 |

Additional arrangements We pay for or reimburse Directors for transportation, hotel, food and other incidental expenses related to attending Board and committee meetings, director orientation or other relevant educational programs or Company meetings.